Starting with the Flipkart-Walmart deal, 2018 is turning out to be the best ever for startups in attracting capital since the funding boom on 2014-15

Mihir Dalal & Anirban Sen from LiveMint.com August 6, 2018

Caption:

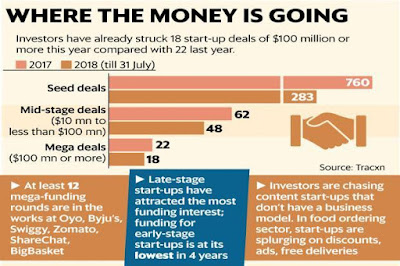

At least 12 mega funding

rounds are in the works at Oyo, Byju’s, Swiggy, Zomato, ShareChat

and BigBasket. Graphic: Mint

Bengaluru: Startups

have been raising multiple rounds of capital in quick succession at

increasingly higher valuations. Investors are chasing startups that

don’t generate any revenue—at least not yet—and market share is

the preferred investment metric, not unit economics. Is another

hyper-funding wave around the corner for startups?

Increasingly, this year is

resembling 2014, when a handful of relatively mature startups raised

huge sums. That year was followed by a broader hyper-funding wave in

2015 when it seemed that all you needed to raise cash was a degree

from a top engineering college and the word “hyperlocal”, which

was the flavour of the day then, in your investor pitch.

Investors have already struck

18 deals of $100 million or more this year compared with 22 last

year, according to Tracxn data. At least a dozen more such deals

including mega funding rounds at Oyo, Byju’s, Swiggy and Zomato,

ShareChat, BigBasket and others are in the works, according to

previous reports in Mint. Factor in the $16 billion sale of Flipkart

to Walmart and it’s clear that this will be the best-ever year for

startups in terms of attracting capital, a stark contrast to the weak

investment activity in the last two years.

The jury is out on whether

this bumper year will be followed by an investment frenzy similar to

that of 2015.

But there are some early

signs. startups such as Swiggy, Zomato and CureFit are attracting

large rounds of cash in quick succession and at soaring valuations.

Investors are chasing content startups that have no business model in

sight. And, in some sectors such as food ordering, startups are

spending wantonly on discounts, advertising and free product

deliveries, though still not at the levels seen in 2015.

“While the ecosystem of

companies has grown, the number of quality startups in the later

stages has not grown at the same pace,” said Sharad Sharma, an

angel investor and co-founder of iSpirt, an industry group for

software products startups. “As a result, investors have fewer mid-

to late-stage companies to back and double down on. Other than the

category leaders, the ones that have just managed to survive but

haven’t really taken off in a big way are also getting funded in

the current wave. So, in mid- to late-stage deals, we’re definitely

starting to see the beginning of a bubble.”

Mint had reported on 20 March

that start-up funding may bounce back this year.

To be sure, it’s not clear

if investor enthusiasm for mature internet companies will trickle

down to early-stage startups. Funding for early-stage startups is at

its lowest in four years, Tracxn data shows. And many investors have

raised concerns about the low rate of new start-up formation.

Some investors said VCs and

startups had learned from their mistakes in 2014-15 and it is

unlikely that a bubble-type scenario would be repeated this time.

“The environment is very

different from (that in) 2014-15,” said Ritesh Banglani, partner,

Stellaris Venture Partners. “First, there is clear evidence of

exitability of Indian internet companies. Second, companies that are

raising large rounds are mostly market leaders who have proven the

benefits of scale. Third, companies like Swiggy and Zomato that are

raising big rounds have demonstrated good unit economics. So, most

growth-stage funding is going towards building scale rather than

proving business models, which was the case in 2014-15.”

Dev Khare, partner at

Lightspeed India, agreed, saying that unlike 2014-15, VCs haven’t

poured excessive funds in early-stage companies and neither have

late-stage funds made bets on early-stage companies.

“Many investors had come in

earlier during 2014-15 than they otherwise would, and a lot of

sectors got overfunded,” Khare said. “Now, the market has matured

and you’re seeing one or two winners emerge in several sectors. In

India, capital accumulates around the winners pretty quickly, so I

would expect more sectors to get funded in the growth rounds than in

2014-15.”

In the 2014-15 startup

investment boom, Tiger Global made a series of early-stage bets, a

move that gave rise to the term, Fear of Missing Out (FOMO), among

other investors, who followed Tiger Global’s lead. Both Khare and

Banglani said that so far, the FOMO factor isn’t at play. (While

Tiger Global has stepped up its investment pace over the past nine

months, it is avoiding early-stage firms). “What I would see as a

sign of froth would be if international investors were coming in

during A rounds and signing $10 million cheques and investing in

seven-eight companies in each sector. I don’t see that happening

right now,” said Khare.

Source:

No comments:

Post a Comment